Direct Straight Through Processing

A cloud-based virtual account that’s linked to commercial bank accounts, with maximum security, clearing CDD and EDD for Community Investment Program settlements.

Custody

Secure administrative underwriting and warehousing accountholders’ securities.

Clearing

Straight forward regulatory compliances, and securities due diligence.

Payable

Private direct electronic funds transfer to accountholders’ accounts.

Direct Integration

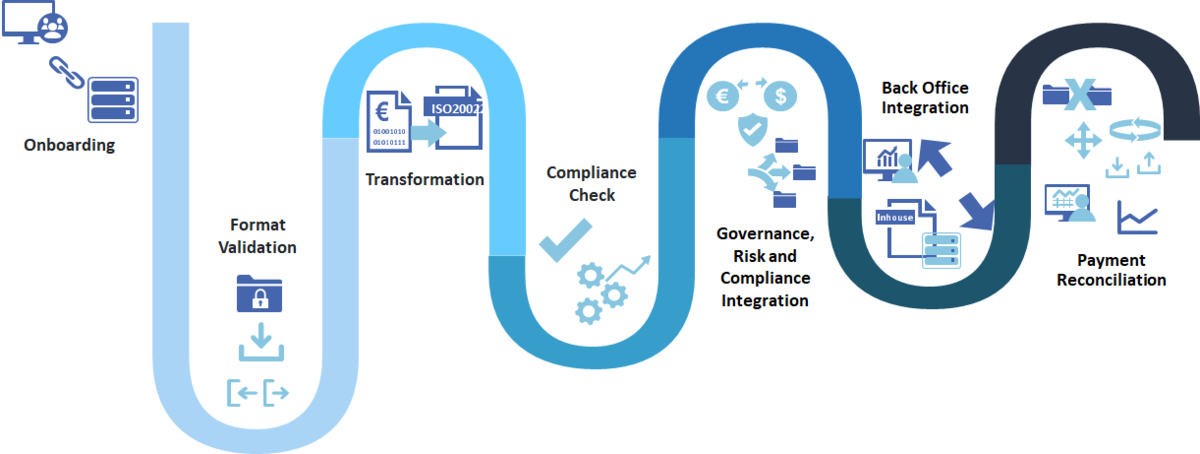

Treasury to Bank T2B is a direct Host to Host connection for its core Peer to Peer integrated receivable and payable. It provides closed circuit secure direct connectivity with domestic intermediary banks; using ISO 20022 XML API, EDI, BAI2, Excel or CSV Files with secure protocols by utilizing some of the active connection types:

- SFTP SSH

- Wholesale Lockbox

- AS2

- HTTPS

- Web Services

- EBICs

T2B payments are transfers made between two banks or corporate to banks without any intermediaries involved, such as the standard legacy intermediaries ACH, Federal Reserve, Swift, TCH. T2B payment process is used for a more efficient data exchange between Treasury Bank Organization’s Community Investment Program and its members business bank account. T2B payment systems allow the automation of many processes of data exchange during transfers, so no time is wasted on performing such operations manually.

During T2B transfers Treasury Bank Organization’s clearing agent, manages T2B file formats, network protocols, and security standards by which it and intermediary banks wants to transfer data to simplifying the payment process for programs and accountholders.

The T2B payment process is used for direct deposit to Community Investment Program account with intermediary banks. The Treasury Bank Organization’s administrators utilize internal book transfer or external ACH or Wire transmittal with its intermediary banking partner, for payouts to accountholders as merchants, contractors, employees, etc.

T2B Transmittal include:

- Push payments: Credit payment; sending one-off payments

- Pull payments: Debit payment; retrieving payment

- Both Push or Pull methods are transmitted from account to account or bank to bank

How Does it Work

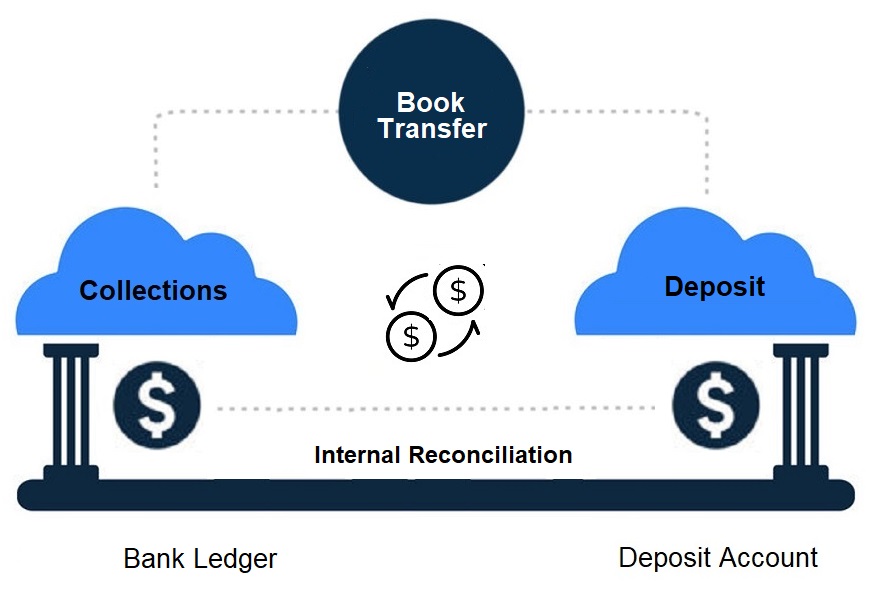

Our direct clearing agent assumes the role of tacit collections and settlement to reconcile orders, between T2B exchanges.

The clearing agent exchanges are SFTP SSH secure connection to an internal master account at intermediary bank. Funds are escrowed for compliance clearing and the transferred to an internal sub accounts as a bank to bank book transfer payment that allows business accountholders to receive payments fast via QR code with application programming interfaces (APIs). This process is a more secure Instant payments to void any other outside character with the payment chain.

T2B Integration Benefits

Benefits of T2B payment integration include:

- Improved compliance Better KCY by procurement credit checks

- Improved efficiency and privacy – straight-through transmission which void unnecessary intermediaries that compromise data

- Better data consistency – minimize human error and data breaches.

- Centralized financial management better procurement, invoicing and cash management.

- More accurate cash flow forecasting – more accurate cash flow forecasts.

- Faster Payments – payments in real-time outside of standard 1 to 10 days Swift, TCH, Federal Reserve, and ACH

- Minimizing Systemic Risk – less data intuition, fraud, and internal or external bad actors.

- Accountholder CDD and EDD Clearing – Jurisdictional prescreening for OFAC regulation support.

Community Investment Inclusion

T2B Payment process is part of a direct effort to make community investment inclusion of local products and services for entrepreneurs in local areas that accessible through Community Investment Programs CIP. Providing grant fund investments with Bank and Card accounts that available to disadvantaged individuals and businesses in all service jurisdictions.

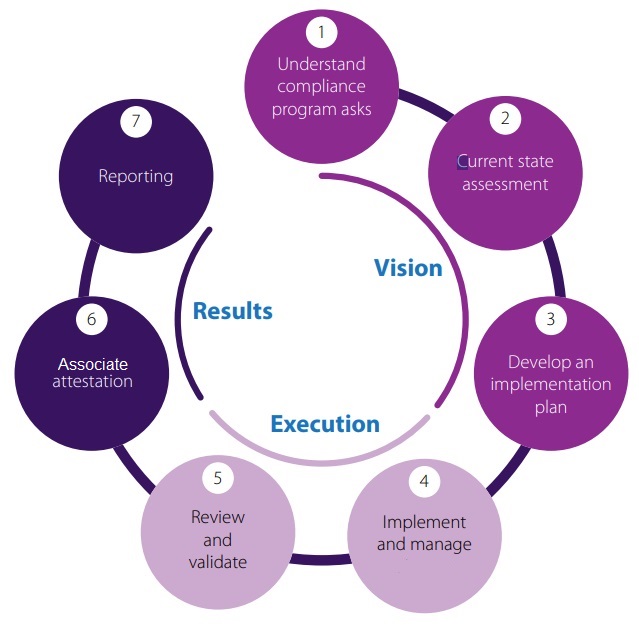

Minimizing Systematic Risk

Treasury Bank Organization adhere to but not limited to the Credit Card Accountability Responsibility and Disclosure Act of 2009 in line with Payment Card Industry Security Standards Council PCISS compliances. Also, FFIEC/FinCen/BSA Travel Rules, internal and external KYC, and OFAC

Treasury Bank Organization provides the following multi-level private non-solicited investment settlement for accountholders.

this allows:

- Non-Consumer commercial transactions

- Member privacy

- Financial inclusion

- Internal control

- Minimize risk

- Minimize Regulation

- Multiple accounts at the same or different banks

Security Measures

- Bank level SFTP SSH connection

- Collect card data using customizable forms you can embed into your application

- Secure card data in a PCI Level 1 compliant and SOC2 certified environment

- Use tokens to send and receive card data or tokens with payment processors or endpoint

- Login Challenge Screen (Password Protected)

- Automated Backups

Automation – Software Integration Kit

- ‘Point and Click’ API with no programming required

- Automate export and importing of records, creating payment file and transmitting to settlement bank

Install and Test

- T2B integration

- Investing support included with all accounts

- fully test treasury payment files with bank

QRC Payments

T2B utilize QR code with Application Programming Interfaces (APIs).

Payment Barcode and QR code

Enable a diverse set of payment services to investments

Payment and Reporting

- Making payment decisions and orders

- Automatic email notification of file creation -interface to SMTP servers

- Export Reports to Excel, Word, or PDF

- Full Audit Trail

Deposit Control

Treasury Bank agent issues a Depository Account Control Agreement DACA that serves to perfect a Treasury Bank’s security interest in the funds in the accountholder’s deposit accounts.

Deposit Accounts

Treasury bank agent form a tri-party agreement between master and sub account to utilizing a parallel settlement between CIP clearing and settlement within the same bank with the following services:

- Opening Bank Account

- Cash Management

- Reconciliation and Audits

With a tri-party DACA, Treasury Bank Administrators act as the deposit account manager that can disburse funds from the CIP clearing account to a member deposit account within the same bank (unless as otherwise noted below)

Types of deposit account control agreements

There are two recognized kinds of DACAs: passive and active.

- Passive DACAs, also called “springing” or “shifting” DACAs: Allow accountholders to use funds disbursed independently as Creator within community investment business operations. In this situation, the Treasury Bank Administration does not direct how the funds in the sub account are used. If the accountholder defaults on the obligation, the Treasury Bank administration can assume control over the accounts and instruct Treasury bank to revoke or resolve the accountholder ability to make transactions using funds in the account.

- Active DACAs, or blocked account control agreements (BACA): Only Treasury Bank, not accountholders, can make transactions.

DACA requirements

All DACAs meet requirements under Article 9 of the Uniform Commercial Code (the UCC), the model statute governing secured transactions adopted in all 50 US States. In order to protect Treasury Bank’s security interest in a deposit account, the Treasury Bank Agent must establish “control” (a UCC term) of that account, meaning the depository bank will comply with the Treasury Bank’s agent instructions without the accountholders consent, without additional restrictions from third parties.

Depository Settlement Banks often have their own standard DACA templates. In both cases, the DACAs are designed to meet Treasury Banks UCC requirements.

Payment Clearing

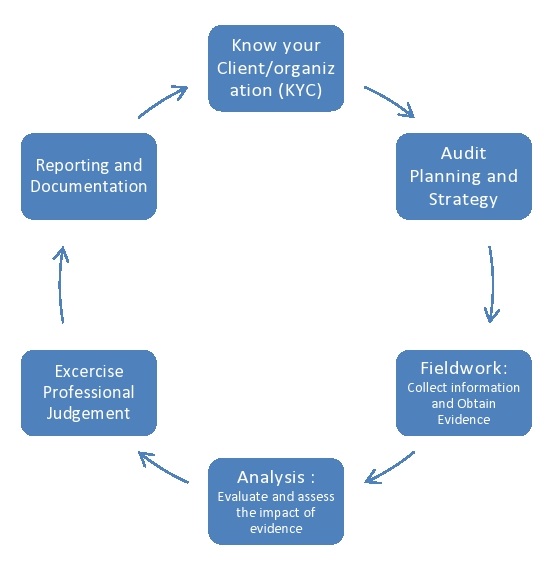

Treasury Bank Clearing is managed by HSC Clearing Corporation. It handles risk management, due diligence, Investment compliance, chief finance services and fiduciary duty.

Risk Management & Due Diligence

Managing risk and due diligence by following policy and plans. Treasury Bank focus on the human element with background investigations. We perform due diligence to make sure that business is conducted correctly by accountholders, their employees, their partners, and vendors.

Investment Compliance

Applying Investment compliance by adhering to laws, regulations and internal policies and procedures that govern the investment sector. This ensures that all investment is carried out in accordance with the rules and regulations set by regulatory authorities.

Chief Financial & Fiduciary Service

Trustee responsibility, checks and balance