Bank Connectivity

Integrating Cloud-Based ERP Systems

Direct Bank to Bank Technology

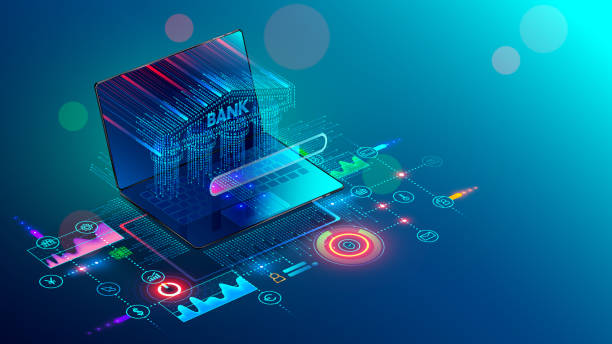

Global credit transfer between Treasury networks, data processor and banks or brokerages with or without standard clearing intermediaries.

Digital Assets Credit Transfer

Globally Transferring digital asset value to bank and brokerages and other intermediaries to be exchanges between different countries and jurisdictions or without standard clearing intermediaries.

ISO20022 Messaging

XML Data Import & Export

Instant SQL connectivity | Direct integrate | XML Easy Reconcillation

Intergration

This integration enables HSC conveniently send payments and effortlessly receive balance and transaction Information directly within their core system.

Data Connectors

Funds are distributed through an international payment network using XML and Rest API combinations.

- Bridge REST APIs with SQL.

- Access Data in the Cloud or On-Prem

- Get Tailor-Made Connectors

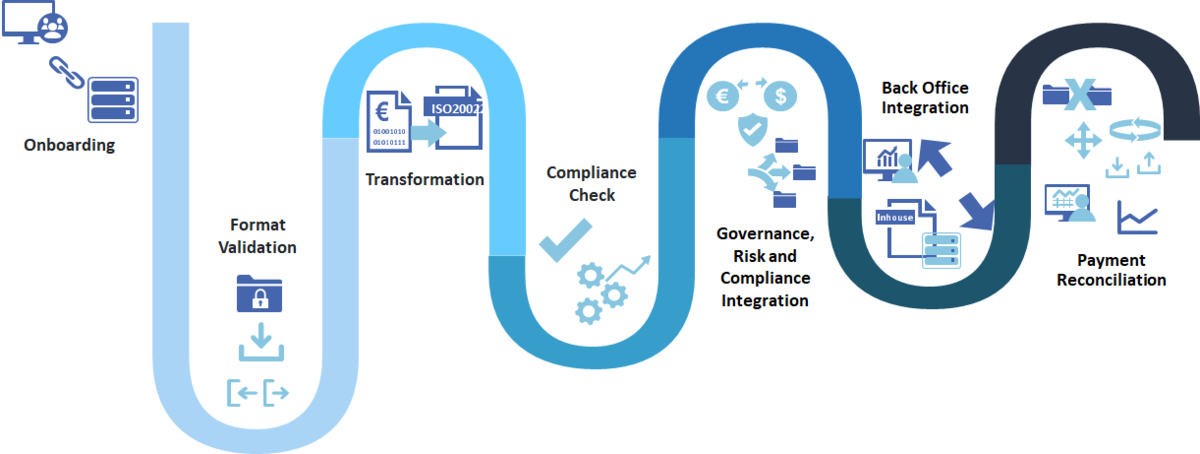

How Does it Work

- Step 1. Clients securities are underwritten and stored as a receivables via open bank XML or JSON API and then book transfer to members payable cash account at bank.

- Step 2 Funds are cleared with back office Compliance as a Service CaaS and held as a digital instrument in parallel with QRC code account.

- Step 3 Member instruct and authorize HSC Clients to transfer data virtually, from magnetic tape, or chip as credit or debit transactions.

- Step 4 Clients issue a command with data processor via QR code using XML and Application Programming Interfaces (APIs) for virtual or physical transfers for members.

Transfer and Reporting

- Making funds transfer decisions and orders

- Automatic email notification of file creation -interface to SMTP servers

- Export Reports to Excel, Word, or PDF

- Full online and transparent audit trails

Security

- Risk Management & Due Diligence

- Investment Compliance

- Chief Financial & Fiduciary Service

Transfer Overview

Banks generally separates its transfers into high and low value streams:

- High value transfer (inter-payments)

- Low value transfer (external retail payments).

High value transfer are settled instantly H2H P2P, B2B. Low value payments are batched and settled generally via ACH at end of day or 1 to 3 days.